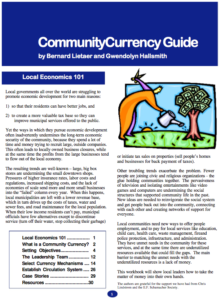

Complementary currencies are agreements within a community to accept something else than national currencies as a means of payment. They are sometimes called community currencies, local currencies or “common tender.” Not all these common tender currencies are local, however, and some have purposes other than community building. Because they are designed to function in parallel with conventional money — not replacing but complementing national currencies–we will use the terminology of “complementary” to describe them.

Complementary currencies are agreements within a community to accept something else than national currencies as a means of payment. They are sometimes called community currencies, local currencies or “common tender.” Not all these common tender currencies are local, however, and some have purposes other than community building. Because they are designed to function in parallel with conventional money — not replacing but complementing national currencies–we will use the terminology of “complementary” to describe them.

New monetary innovations are now being crafted and used by an ever-growing number of communities worldwide to address a wide array of different social and economic mandates: from effectively caring for the elderly in Japan, to urban renewal in communities like Curitiba or Palmeiras in Brazil, providing new jobs and significantly raising the standard of living in communities, all without incurring costs to government or industry. The potential and adaptability of social currency innovations are part of the shift from the Industrial Age to a Post-Industrial or Information Age. Most of them would not have appeared without cheap computing power becoming available. This also explains their impressive growth from a handful to thousands such currency systems worldwide in the past two decades.

Mounting evidence from these practical experiments in diverse communities around the globe demonstrates that complementary currencies can have significant positive impacts on communities that use them. These new kinds of currencies are addressing critical social problems for which conventional money has proven inadequate such as the erosion of community, ecological deterioration, the need for elderly care, and much more.

We now have a number of well documented success stories of complementary currencies that were introduced by governments, with very positive results. Two well known such experiments are the Wörgl in Austria and Banco Palmas in Brazil.

The Wörgl experiment (Austria: 1932-1933)

In the mist of the Great Depression, the Austrian town of Wörgl made economic history by stimulating its local economy through the introduction of a stamp scrip. The Wörgl experiment was conducted from July 1932 to November 1933 in a little Austrian town of 4,500 inhabitants under the leadership of its mayor. It is a classic example of the potential efficacy of local currencies, demonstrating that a depressed community in an apparently hopeless situation can find a way to end the seemingly intractable challenges of unemployment, local decline and lack of a reliable tax base.

Banco Palmas in Brazil (1998-present)

With the help of NGOs, people in Palmeiras, an impoverished district in Fortaleza, Ceara, Brazil organized and set up a community credit bank. The currency of this bank is called Palma and it is in this currency that inhabitants there sell, buy and stimulate the local economy. The government decided to generalize the dual currency system in place at Banco Palmas to 200 local banks and requested that the Banco de Brazil (largest government-owned bank) make this happen.

The Saber: A Proposal for a Government-Backed Education Currency

The Saber is a government-backed complementary education currency proposed by Bernard Lietaer to help Brazilian schools provide greater educational opportunities despite the lack of available funds. The educational vouchers are designed to set in motion a substantial “learning multiplier” so that a given amount of money can facilitate substantially more learning for a greater number of students. The currency would fuel this learning multiplier without creating any new financial pressure on the economy.