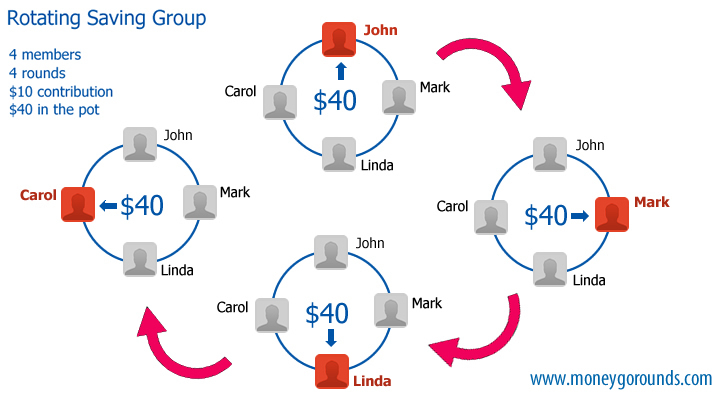

Rotating savings and credit associations (ROSCA) are among the oldest and most prevalent savings institutions found in the world and play an important role in savings mobilization in many developing economies. Roscas are locally organized groups that meet at regular intervals; at each meeting members contribute funds that are given in turn to one or more of the members. Once every participant has received funds, the rosca can disband or begin another round.

Rotating savings and credit associations (ROSCA) are among the oldest and most prevalent savings institutions found in the world and play an important role in savings mobilization in many developing economies. Roscas are locally organized groups that meet at regular intervals; at each meeting members contribute funds that are given in turn to one or more of the members. Once every participant has received funds, the rosca can disband or begin another round.

In joining a rosca, an individual agrees to a schedule of periodic payments in return for which she receives a lump-sum payment at a future date. Roscas often pay no interest and participants may have little or no control over when they receive the funds. Participants also bear the risk that other participants may not fulfill their obligations.

Why would anyone join a rosca instead of saving alone?

Economic theories suggest that individuals join roscas to finance the purchase of a lumpy durable good, as a response to intra-household conflict over preferences, or to provide insurance. This website proposes an alternative hypothesis for rosca participation: saving requires self-discipline, and roscas provide a collective mechanism for individual self-control in the presence of time-inconsistent preferences and in the absence of alternative commitment technologies. As many rosca participants put it: “you can’t save alone.” A simple idea is that roscas can serve as a commitment device and shows how repeated interaction can sustain roscas even without the use of community-level social sanctions. The commitment idea is consistent with the design of these roscas.

First, most rosca participants report that they join roscas in order to commit themselves to saving, “to get the strength to save.” A key feature of roscas is the public nature of deposits and the inability to withdraw funds once they have been deposited.

Second, participants do not always value earlier positions in the rosca allocation more highly, implying credit is not the reason for joining a rosca. Third, roscas monitor and enforce an individual’s payments to herself as well as her payments to the group. Finally, many rosca participants “bind their hands” through the use of a pre-commitment mechanism in which participants agree in advance on how they will use their funds and the group monitors the individual to ensure that she honors her commitment.