The need for access to lines of credit and venture funding is a fact of life for small start-up businesses all over the world. When you start a business, you need capital to purchase supplies and materials, rent out a space in which to conduct your business, pay your vendors and employees and market your business adequately.

The need for access to lines of credit and venture funding is a fact of life for small start-up businesses all over the world. When you start a business, you need capital to purchase supplies and materials, rent out a space in which to conduct your business, pay your vendors and employees and market your business adequately.

In the United States, Canada and much of Europe, businesses have a wide array of choices for seeking out loans and credit lines for their businesses. But many small businesses in developing nations are run by those living in extreme poverty with little to no collateral to back credit applications. Business owners or self-employed people living in emerging economies may encounter serious, even impossible challenges finding banks or other financial institutions to fund their business ventures.

Microfinance institutions, or MFIs, seek to bridge the gap between small business owners in extremely poor areas of the world and access to lines of business credit by providing loans in tiny amounts to the very poor. These loans may only be a few hundred dollars, and almost always under $1000 — much smaller amounts than loans from a traditional bank, so that the borrower has the means to repay within a reasonable set time. By providing microcredit to the very poor, MFIs seek to be a means to an end in eradicating poverty by empowering the very poor to create business and employment opportunities for themselves and their communities.

How Microfinance Works

Essentially, microfinance institutions work much like traditional banks, just on a much smaller scale and with a much more targeted market. Microfinance institutions give microloans to their clients, which are loans in very small amounts.

In turn, the clients must repay with some interest over a preset amount of time. In this regard, microlending has been very successful, with an average repayment rate across all microlending institutions between 94-98%.

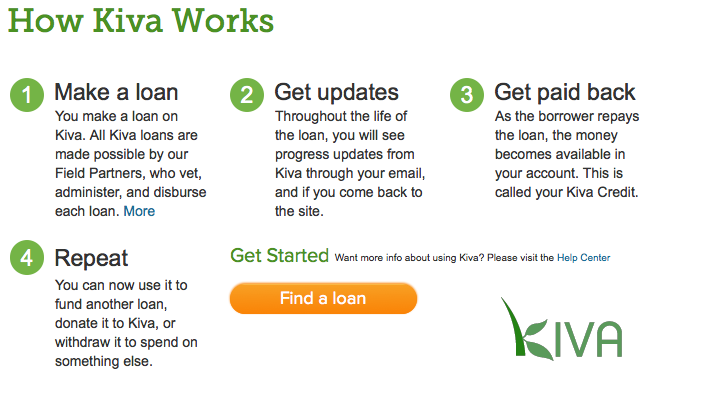

Some nonprofit organizations such as Kiva International fund their microloans with the capital of individual investors and allow person-to-person microlending. Kiva, Hope International and other similar microfinance nonprofits (see links below) accept investment contributions from private donors in as little as $25 increments. The organization pools all the individual contributions together to make one lump sum microloan to the clients. For example, if a client is applying for a $500 loan, that loan could be funded by up to 20 individual investors contributing $25 apiece.

When the client repays the loan, the individual investors get their money back, sometimes with interest depending on the institution. Investors can then re-invest the amounts into another loan for another business owner, or withdraw the funds.

How Microfinance Helps

The vast majority of recipients of microloans are very poor women in developing nations. Women make up over 70% of the world’s poor, and the majority of poor women in emerging economies are the sole financial provider for their families. Through microloans, MFIs hope to level the playing field for these families in the following ways:

- Giving poor families the means to lift themselves out of poverty.

By opening access to the capital necessary to sustain and nurture a business, and providing the business education necessary to run and grow a successful small business, MFIs give very poor microbusiness owners, often very poor women, a powerful tool to work towards escaping poverty. - Empowering women to have greater influence in their communiites.

Women who run successful businesses, provide employment opportunities in their communities and have greater spending power also have greater confidence and greater social status in many poor communities. By providing collateral funding and a means to developing success with her business, a woman in an emerging economy develops the confidence and the status to have a greater say in shaping her community. - Creating a domino effect of economic growth in poor communities.

Families who have access to business credit lines don’t just spend more money on their businesses: they spend more on supplies from local vendors, create more job opportunities in their communities, and spend more on household necessities such as clothing and education. Microloans don’t just create greater cash flow for individual business owners, but for the entire local community.